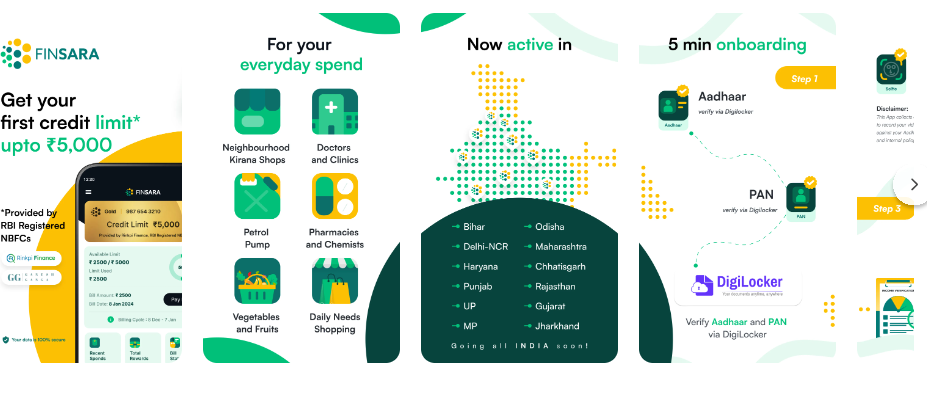

If you want instant money or looking for a loan approved, then you are in the right place where Finsara will get your loan approved instantly. Finsara is an AI lending platform that partners with the NBFC and banks to provide customer loans using non-traditional variables such as salary, employment, education, and many more.

Their goal is to help millions of Indians by them the fairest, clearest, and most personalized credit by correctly underwriting them. They are on the hook to build up a full-loop ecosystem of customers, employers, merchants, and lenders. From the grocery to the medical store, easily transfer money to your bank account and see your credit score grow. Once your subscription is done with the platform, A special surprise for the customer, after using the Finsara for 4 to 6 months, you will be eligible for the Finsara Flexi personal loan and much more.

How to Download and Use Finsara App In Easy Steps?

Finsara policies and services are regulated and legally compliant, while it is a lending platform and does not give out loans instantly to users. This platform is designed for financial management and allows people to pay bills and manage daily expenses without fear of losing money.

- Download the Finsara App from the Play Store or the website to make an account.

- Create an account on Finsara by entering details and verifying emails then log in with your new credentials.

- Fill out your profile with the business or personal information to customize the platform based on your needs.

- After logging in, you will see a dashboard overview of your financial status, including insights into income, expenses, and other financial metrics.

- Then connect your bank account to the Finsara to import the money transaction automatically.

- Record income by adding entries for sales or revenue by categorizing each for better tracking.

- Use the budgeting features to set monthly or yearly spending limits and notify when approaching them.

- Set reminders for upcoming bill payments or other financial obligations and manage to pay on time.

Why Finsara Credit Limit Is A Financial Choice?

Choosing the Finsara credit limit service offers unique advantages for individual and businesses looking to access flexible credit options tailored to their financial needs. With the competitive interest rates, compared to credit card options, the credit limit allows accessing funds for a short period.

- Flexible Credit Access – Finsara credit limit allows you to access funds up to a set limit, providing financial flexibility and can borrow only what you need or repay as you go, unlike the traditional loans that disburse a lump sum.

- Customized Credit Options – It accesses your budgetary profile to offer a credit constraint that suits your particular needs, permitting you to get to the correct sum of credit for individual costs, commerce buys, or cash stream administration.

- Flexible Repayment Terms – Finsara’s credit restrain offers flexible repayment options that adjust along with your cash stream. You should pay the amount as it were on the sum you utilize, which is perfect for clients who require incidental, not consistent, get-to stores.

- Seamless Integration – For users as of now on Finsara’s platform, joining a credit line with other budgetary tools like budgeting, money-related arranging, and cost tracking creates a one-stop shop for monetary administration.

- Easy Application and Quick Support – The application process is streamlined and digital, allowing for quick approval and quick access to the funds when it is needed and this service makes it an urgent expense.

Eligibility Criteria to Apply for the Loan

- The user must be more than 20 years old.

- Must have PAN and Aadhar card which should be linked to the mobile phones.

- Have a UPI-enabled app like Google Pay, Phone Pay, Paytm, and many more.

- Minimum have a salary of INR 15,000 per month to be available for the loan.

- The minimum household income should be more than INR 3,00000 not less than that.

How Can I Avail Instant Finsara Personal Loan

After using the Finsara for up to 4 to 6 months, you will be eligible for the Finsara Personal loan as per your credit score or amount. Finsara facilitates personal loans through its RBI-approved NBFC to select customers based on the good repayment behavior that would be done by the customer.

Flexi loan amounts range from INR 10,000 to INR 50,000 and tenure can vary from 3 months to 36 months. The annual percentage rate will be up to 36% but the actual APR can be lower based on an individual’s credit profile, although most of the customers are insecure about the much lower APR.

The Responsible Lending of Finsara

- Through Credit Assessments – It evaluates borrowers’ financial profiles to determine their eligibility and ensure they can afford a loan without overburdening their finances reduces the risk of default and protects borrowers from unstable debt.

- Flexible Repayment Options – It offers adaptable reimbursement plans custom-made to personal borrower needs. Borrowers can select terms that adjust with their pay, making it simpler to oversee installments without monetary strain.

- Accessible Customer Support – It gives dedicated users back to help borrowers with questions, reimbursement alterations, or direction on the off chance that money-related challenges emerge. This steady approach can offer assistance to avoid wrongdoing and monetary hardship.

- No Predatory Practise – Sters clear of predatory lending tactics, such as exorbitant interest rates or unnecessary fees, instead focus on fair and ethical lending practices that promote long-term financial health.

Let’s Sum Up

Choosing Finsara can be a good choice for you to make your daily expenses easy and not have to hurry to pay the bills because Finsara gives you better days to pay the bills. This platform is especially valuable for those who value convenience, integrations with financial tools, and responsible credit management.

Frequently Asked Questions ( FAQ’s)

Q – What should be the minimum salary of the user to take a loan from Finsara?

A – The minimum salary of a user should be INR 15,000 to apply for a loan from the platform.

Q – What is the end date to pay any bills on Finsara?

A – The last date to pay the bill on the platform is the 8th of every month.

Q – Where is the headquarters located?

A – Finsara headquarters is located in Gurugram, Haryana, which comes under the Delhi NCR and it was established in 2022.

Also Read: